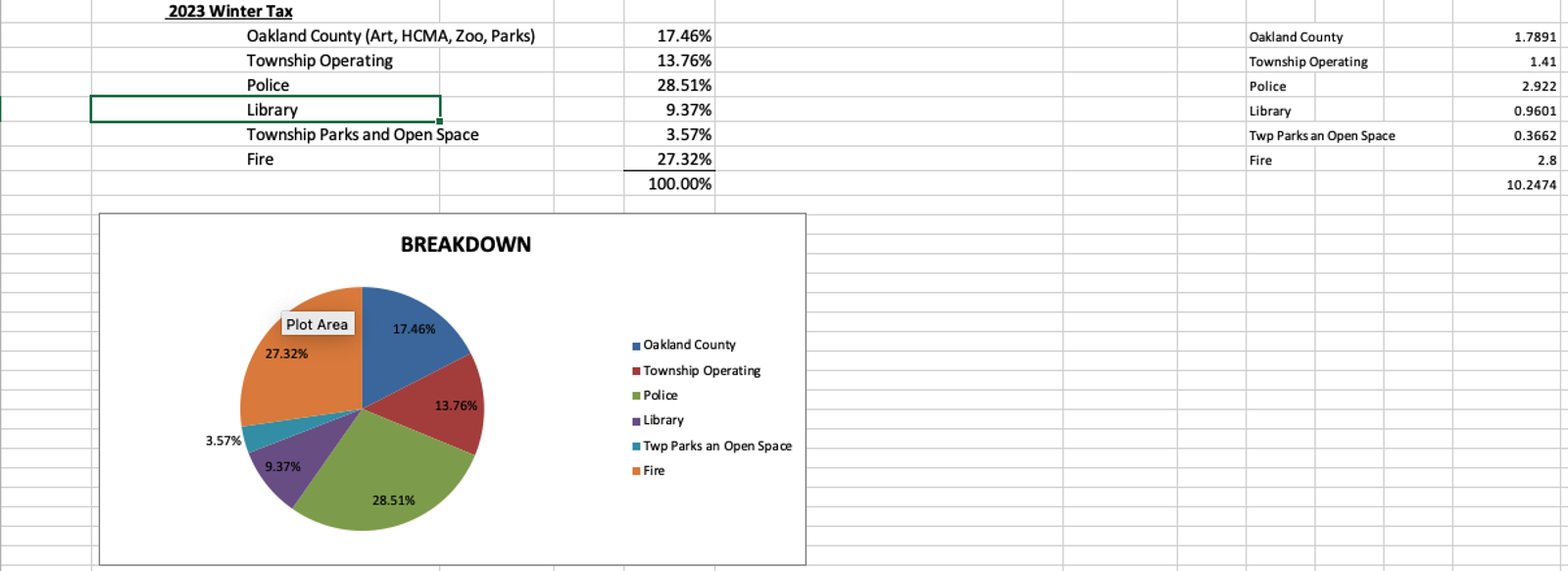

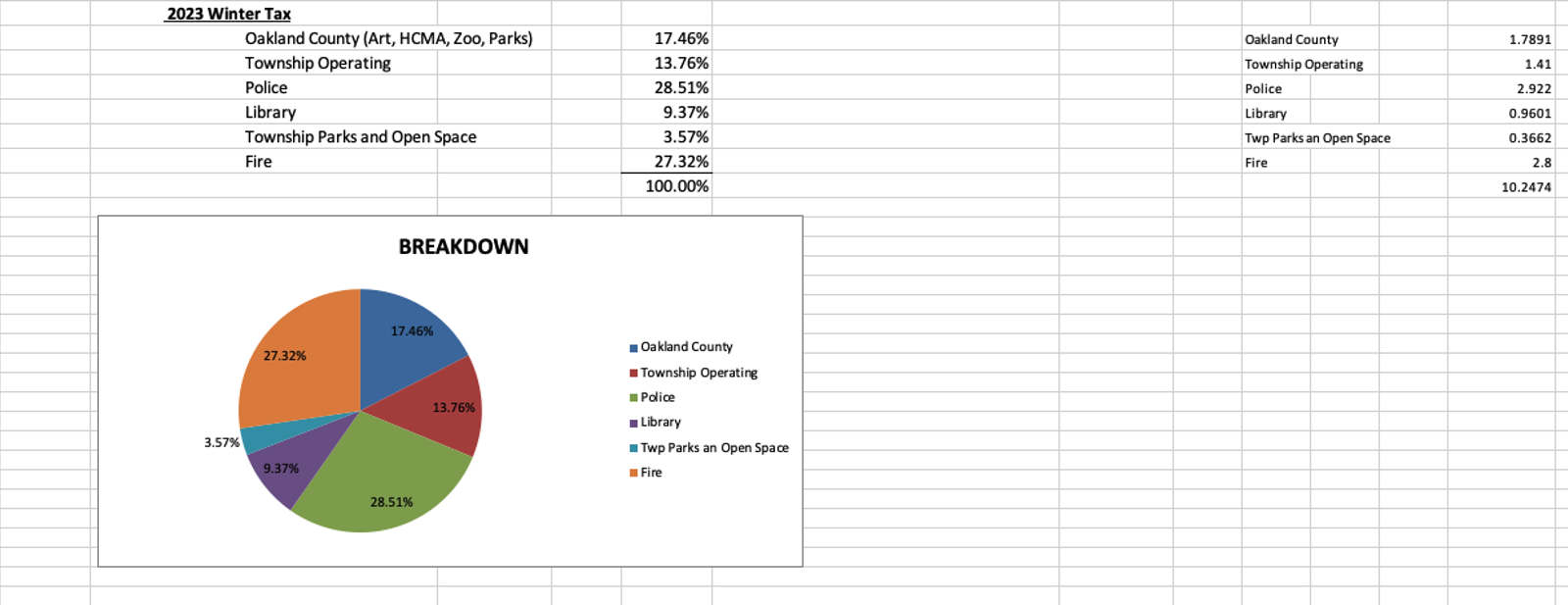

Winter Tax Bill

The winter tax bill represents 100% of your Township taxes, the Zoo tax, the Art Institute tax, the County Huron Clinton Metropolitan Authority, Oakland County Transit, and Parks and Recreation tax. Also included in the winter tax bill are any unpaid annual installments for special assessment that were not paid before October 1, 2023.

Some tax bills may include special assessments that pertain to your property for items such as: street lights, dust control, aquatic weed control, Township – wide trash collection, and lake level and drain assessments.

Winter taxes are payable from December 1, 2023 through February 14, 2024 without penalty or interest. Beginning February 15, a 3% per month interest penalty will be added.

Payments can be made, in person, online or dropped off in our dropbox next to our EAST ENTRANCE.

Please Note

Beginning March 1, 2024, all taxes must be paid to:

Oakland County Treasurer

1200 N. Telegraph Road

Pontiac, MI 48341

The County collects a 4% administrative fee and 1% per month interest fee on delinquent taxes. You may reach the Oakland County Treasurer’s Office at (248) 858-0612.

Taxes paid to the Oakland County Treasurer during the month of March, must include a “Revised Statement”. Please contact the Commerce Township Treasurer’s Office at (248) 960-7040 for your “Revised Statement”.

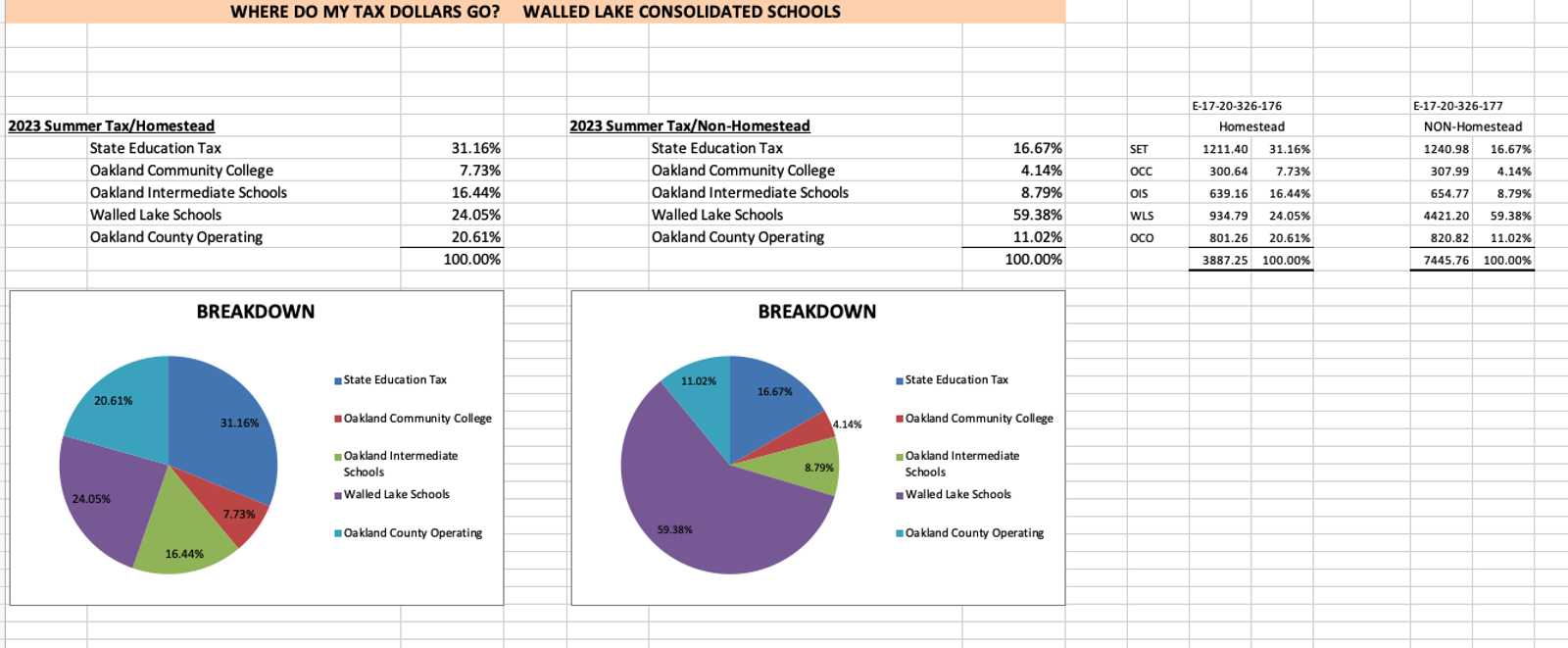

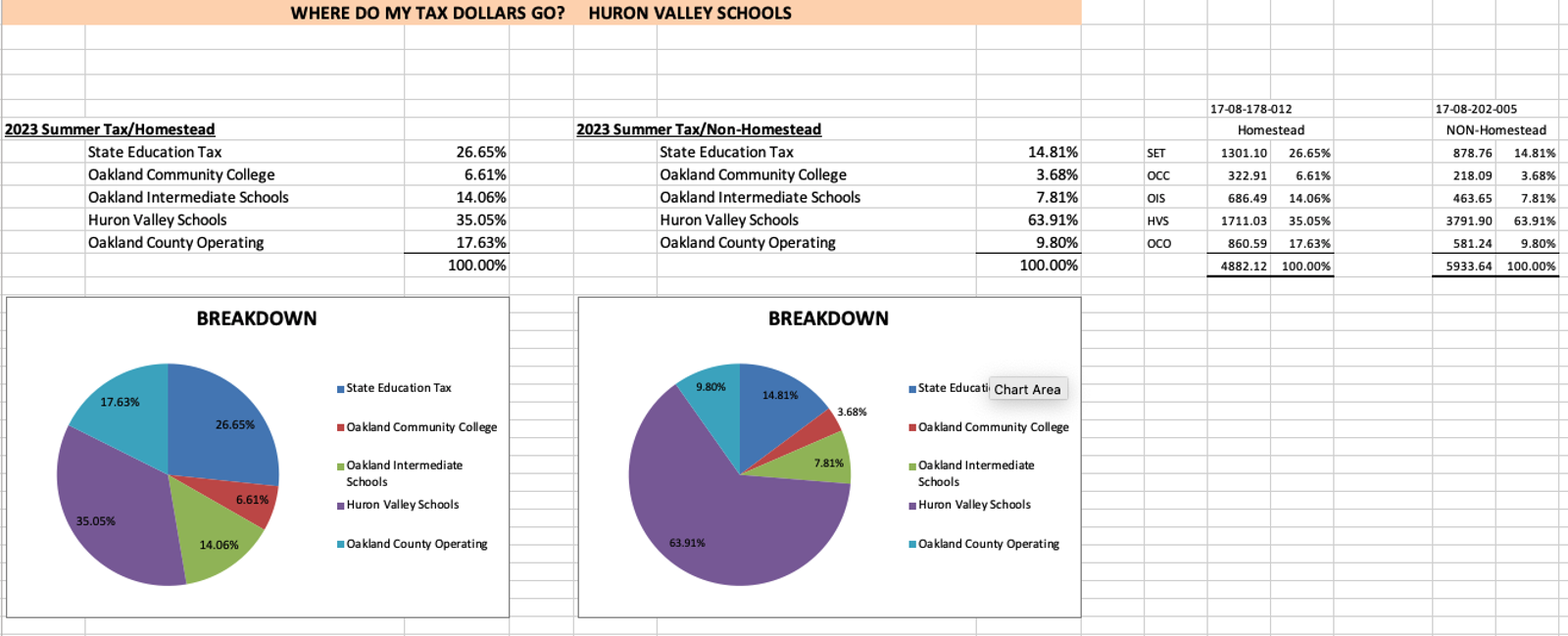

Summer Tax

The Walled Lake and Huron Valley School Districts have contracted with Commerce Township to act as their agent for the collection of the summer taxes. The summer tax bill also represents 100% collection of the taxes for Oakland Intermediate schools, the Oakland Community College, and Oakland County Operating tax. The taxes levied by Commerce Township, Oakland County Parks & Recreation, Zoo Authority, Art Institute Authority, and Huron Clinton Metropolitan Authority will be billed in December.

Should you have any questions regarding your school tax portion of your tax bill call:

Teri Les – Walled Lake Schools (248) 956-2008

Glenna MacDonald – Huron Valley Schools (248) 684-8226

Summer taxes are payable July 1st through September 14th without penalty or interest. Beginning September 15, a 1% per month interest penalty will be added on the 15th day of each month. Beginning February 15th, an additional 3% penalty will be added to the summer tax bill. Failure to receive a tax bill does not waive interest or penalty charges.

Deferral of Summer Taxes

The payment of your summer tax bill can be deferred until February 14, if your yearly total household income was less than $40,000 and you meet one of the following criteria:

*Senior Citizen (Must be Age 62)

*Paraplegic, Quadriplegic

*Eligible Serviceman, Eligible Veteran or Eligible Widow

*Blind Person

*Totally and Permanently Disabled

*Certain Qualifying Agricultural or Horticultural Operation

Application for Deferment of Summer Taxes

Applications are available at the Commerce Township Treasurer’s office and online here.

The application must be signed and returned to:

Molly B. Phillips, Treasurer

2009 Township Drive

Commerce, MI 48390

Return no later than September 13, 2023.

Where do my tax dollars go?